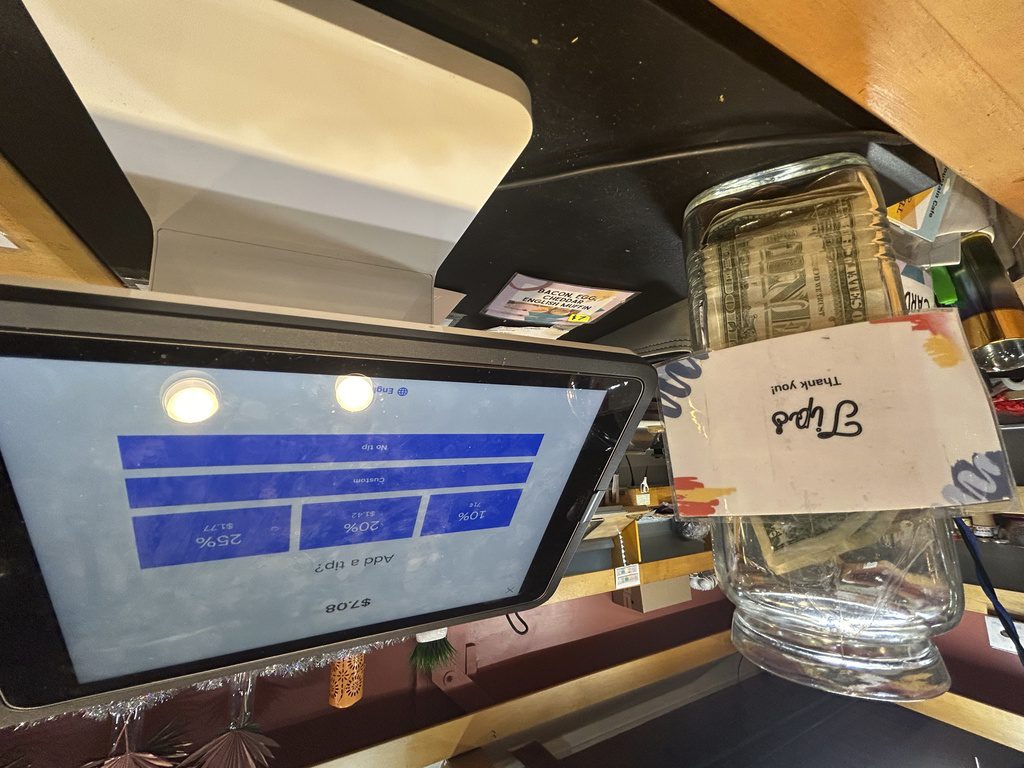

A glass tip jar, left, appears next to a point-of-sale payment system screen displaying tip options at a coffee shop in Waitsfield, Vt., on Wednesday, Nov. 29, 2023. (AP Photo/Carolyn Lessard)

Nevada has the highest concentration of tipped workers in the nation, and those tips are currently subject to federal taxes. A new bipartisan bill would allow hospitality workers to keep their tips without paying federal income tax on them.

Nevada Sens. Jacky Rosen and Catherine Cortez Masto signed onto an effort to make tips exempt from federal income taxes Friday, in an effort to provide tipped workers needed financial relief.

The Democratic senators signed onto the “No Tax on Tips Act,” a bill introduced last month by Republican Sen. Ted Cruz of Texas. Cruz filed the bill after former President Donald Trump suggested making tips exempt from federal income tax during a Las Vegas visit last month.

Rosen and Cortez Masto are the first Democratic lawmakers to sign on to the bill.

“Nevada has a higher percentage of tipped workers than any other state, and getting rid of the federal income tax on tips would deliver immediate financial relief for service and hospitality staff across our state who are working harder than ever while getting squeezed by rising costs,” said Rosen.

When Trump initially suggested the concept in June, the Culinary Workers’ Union Local 226, which represents 60,000 members in Nevada and tends to support Democratic candidates, was skeptical of such a promise due to Trump’s record of opposing unions and supporting anti-worker policies.

“For decades, the Culinary Union has fought for tipped workers’ rights and against unfair taxation,” said the union’s Secretary-Treasurer Ted Pappageorge in a statement at the time. “Relief is definitely needed for tip earners, but Nevada workers are smart enough to know the difference between real solutions and wild campaign promises from a convicted felon.”

Now that the “No Tax on Tips Act” has been introduced and become a bipartisan effort, however, the Culinary Union supports it.

“Workers, unlike big corporations and the super-rich, are willing to pay their fair share and the Culinary Union will always fight to protect workers and against unfair taxes,” Pappageorge said in a statement Friday. “Real solutions are what workers rely on and we are proud to have senators who are fighting to deliver real results for working families.”

Opinion: En honor a nuestra comunidad Hispana, estoy resaltando lo que más importa a mí y a mi familia.

En esta elección, todos estamos luchando por nuestras familias y nuestros negocios. Soy la fundadora de un pequeño negocio que promueve la narración...

Apprenticeship programs are helping Nevadans launch their careers

The number of registered apprentices in Nevada has more than doubled over the past decade and a recent surge of funding from the Biden...

While corporations make billions, inflation continues to hurt Nevadans

Grocery and food companies’ massive profits have drawn increased scrutiny from lawmakers, including Nevada Sens. Jacky Rosen and Catherine Cortez...

El Día Internacional de los Trabajadores fue dedicado a los varilleros

Este año, Arriba Las Vegas Worker Center conmemoró el Día Internacional del Trabajador con una caravana de acciones en las que destacaron...

Biden makes 4 million more workers eligible for overtime pay

The Biden administration announced a new rule Tuesday to expand overtime pay for around 4 million lower-paid salaried employees nationwide. The...

Biden administration bans noncompete clauses for workers

The Federal Trade Commission (FTC) voted on Tuesday to ban noncompete agreements—those pesky clauses that employers often force their workers to...