WASHINGTON, DC - SEPTEMBER 21: Sen. Jacky Rosen (D-NV) speaks during a hearing to discuss security threats 20 years after the 9/11 terrorist attacks at the U.S. Capitol on September 21, 2021 in Washington, DC. (Photo by Greg Nash - Pool/Getty Images)

Households benefiting from the changes to the child tax credit would see an average tax cut of $680 in the first year, according to estimates from the nonpartisan Tax Policy Center.

Nevada Sen. Jacky Rosen on Thursday sent a letter to Senate Majority Leader Chuck Schumer (D-New York), calling on him to put a bipartisan tax cut package on the Senate floor for a vote.

The $78 billion package, which passed the House in a 357-70 vote on Wednesday, would enhance the child tax credit for millions of low-income families while also increasing three business tax breaks.

In her letter, Sen. Rosen touted her belief that the Tax Relief for American Families and Workers Act would benefit Nevada families.

“I write to express my strong support for the Tax Relief for American Families and Workers Act that passed the U.S. House of Representatives last night with broad support from both sides of the aisle,” Rosen wrote. “This bipartisan legislation will lower costs for hardworking Nevada families, increase the supply of affordable housing, and help our small businesses grow and thrive.”

Democrats have fought particularly hard to expand the child tax credit, which currently excludes many of the poorest families.

The current credit currently gives most middle- and high-income parents $2,000 per child, because it reduces taxes owed. But since the credit is not fully refundable, many low-income families—especially those with multiple children—haven’t been able to benefit from it because they don’t owe enough in taxes.

The new bill would expand eligibility for the child tax credit among these low-income families, allowing them to claim it for each child, even if they don’t qualify for the full $2,000. Currently, the poorest families can only receive payments for one child.

The bill would also slowly raise the amount of the credit available as a refund, boosting it to $1,800 for 2023 tax returns, $1,900 for 2024 tax returns, and $2,000 for 2025 tax returns, and also adjust payments for inflation for the 2024 and 2025 tax filing years.

As the Washington Post reported, under the legislation, a single mother with three children earning $10,000 annually would see their credit triple from $1,250 to $3,750.

The expansion is “expected to lift nearly half a million children out of poverty within the first year, benefiting 163,000 children in Nevada alone,” Rosen wrote in her letter.

Households benefiting from the changes would see an average tax cut of $680 in the first year, according to estimates from the nonpartisan Tax Policy Center.

Families that earn under $2,500 per year would still be excluded from receiving the credit, however, due to Republicans’ opposition to making them eligible.

Democrats wanted to restore the more generous temporary credit they passed in 2021 as part of President Joe Biden’s American Rescue Plan—which was $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17—but were forced to compromise.

While Democrats mostly focused on the child tax credit, Republicans were eager to restore the deductions that businesses can take when they buy new equipment and machinery, as well as those for domestic research and development spending. The bill also gives businesses more latitude to determine how much of the money they borrow can be deducted.

The bill also would boost a tax credit for the construction or rehabilitation of rental housing for lower-income households. If signed into law, the legislation would add an estimated 200,000 housing units around the country.

“From Las Vegas to Reno, Nevadans are facing skyrocketing housing prices, and we need to do everything we can to lower these costs,” Rosen wrote. “The need for more affordable housing is growing more urgent by the day, and the provisions in this package will ensure that more Nevadans have access to affordable, quality housing options.

“At a time when families in Nevada and across the country are facing high costs across the board, this bipartisan tax package would give families some needed breathing room,” she continued. “The need for more affordable housing is growing more urgent by the day, and the provisions in this package will ensure that more Nevadans have access to affordable, quality housing options.”

The full text of Rosen’s letter can be found HERE.

Opinion: En honor a nuestra comunidad Hispana, estoy resaltando lo que más importa a mí y a mi familia.

En esta elección, todos estamos luchando por nuestras familias y nuestros negocios. Soy la fundadora de un pequeño negocio que promueve la narración...

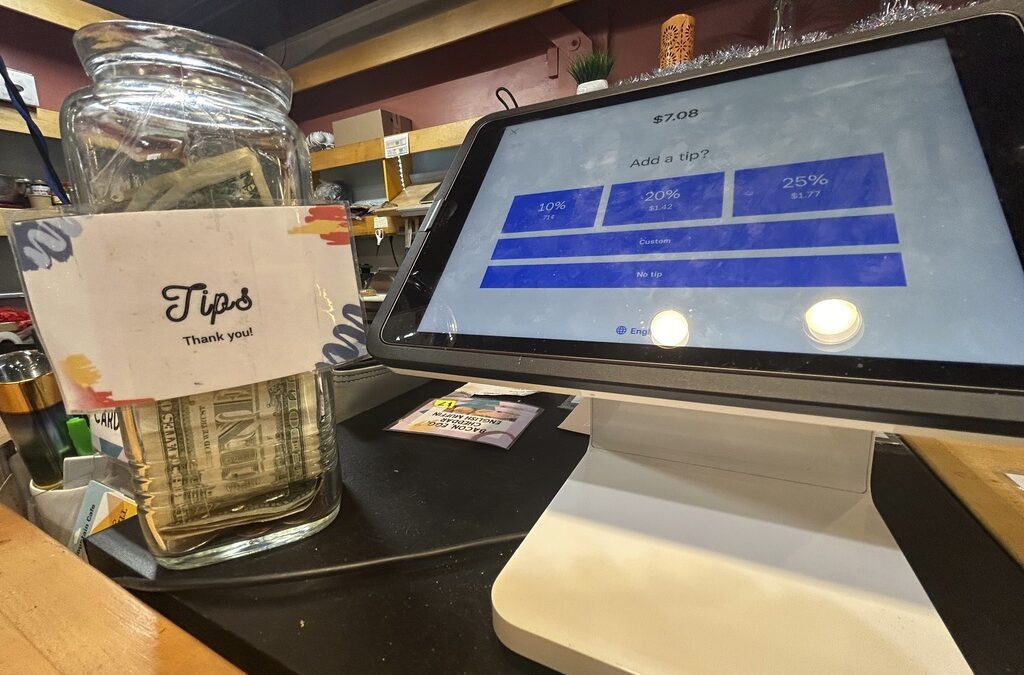

Nevada Senators Rosen, Cortez Masto support effort to exempt tips from taxes

Nevada has the highest concentration of tipped workers in the nation, and those tips are currently subject to federal taxes. A new bipartisan bill...

Apprenticeship programs are helping Nevadans launch their careers

The number of registered apprentices in Nevada has more than doubled over the past decade and a recent surge of funding from the Biden...

While corporations make billions, inflation continues to hurt Nevadans

Grocery and food companies’ massive profits have drawn increased scrutiny from lawmakers, including Nevada Sens. Jacky Rosen and Catherine Cortez...

El Día Internacional de los Trabajadores fue dedicado a los varilleros

Este año, Arriba Las Vegas Worker Center conmemoró el Día Internacional del Trabajador con una caravana de acciones en las que destacaron...

Biden makes 4 million more workers eligible for overtime pay

The Biden administration announced a new rule Tuesday to expand overtime pay for around 4 million lower-paid salaried employees nationwide. The...