Tax forms, US currency, calculator, and a pen. (Shutterstock Photo/RomanR).

By Damon C. Williams and Chad Murphy

Monday, Jan. 26 marked the beginning of the 2026 tax season.

Nevadans who have already filed their taxes can expect refunds within the next several weeks. Those still waiting on W-2 forms can expect documents from their employers by the end of January. For everyone else, there are still several months before the filing deadline.

Whether you’re looking forward to your return, waiting on tax documents, looking to file your taxes this week, or wondering how long you can wait to file, here’s everything Nevadans need to know about the 2026 tax season.

How can I check the status of my refund?

You can check the status of your 2021 through 2025 tax returns through the IRS’ refund status portal.

When will I get my refund?

USA.gov confirms you should receive your 2025 tax refund within 21 days after filing.

According to the IRS, you’ll be able to check the status of your 2025 income tax refund 24 hours after you e-file a current-year return; three or four days after you e-file a prior-year return; and four weeks after you file a paper return.

What is delaying my tax refund?

If it’s been longer than 21 days since you’ve filed your tax returns and have yet to receive a refund, the IRS notes there could be several factors causing the delay.

- The return has errors, is incomplete or is affected by identity theft or fraud

- The return needs a correction to the child tax credit or recovery rebate credit amount

- The return has a claim filed for an earned income tax credit, additional child tax credit, or includes a Form 8379, Injured Spouse Allocation

- The time it takes a taxpayer’s bank or credit union to post the refund to the taxpayer’s account.

How much will my tax refund be?

According to the IRS, the average refund amount for 2025 stood at $3,186, 3.2% higher than 2024’s average tax refund of $3,088.

BankRate notes the lowest return amount over the past ten years occurred in 2020, when the average return was $2,549.

When do W-2s come out?

Your employer has until Jan. 31 to send your Form W-2, either by mail or electronically, according to H&R Block.

What is the deadline to file taxes?

Tax returns must be filed by April 15, per the IRS, unless you file for an extension.

What is the deadline to file an extension?

According to the IRS, the deadline to file for an extension is also April 15, giving taxpayers until Oct. 15 to file without penalties.

However, you still must pay any taxes owed by April 15. The extension only applies to filing a tax return.

Where can I file my taxes for free?

If you make less than $89,000 annually, you can utilize multiple free tax filing services are verified by the IRS at apps.irs.gov/app/freeFile/.

Some of the free filers IRS recommends include Tax Slayer, 1040.com, OLT, and TaxAct.

Does Nevada have a state income tax? Why doesn’t Nevada have state income tax?

Nevada has never levied a state income tax on individuals or corporations.

Nevada’s state constitution prohibits a personal income tax. Changing that would require voter approval in two consecutive elections or passage in two legislative sessions, which occur every two years.

USA TODAY Network via Reuters Connect

Carly Sauvageau from the Reno Gazette Journal contributed to this report.

Empresa latina de Nevada asfixiada por las reformas de Trump

Aranceles nuevos, deportaciones masivas y recortes a programas de energía limpia han golpeado de lleno a Allegiant Electric, una empresa de...

Gambling provision in Trump’s megabill is primed to hurt Nevada’s economy

By Dana Gentry, Nevada Current A provision of President Donald Trump’s One Big Beautiful Bill Act that caps the federal tax deduction for gambling...

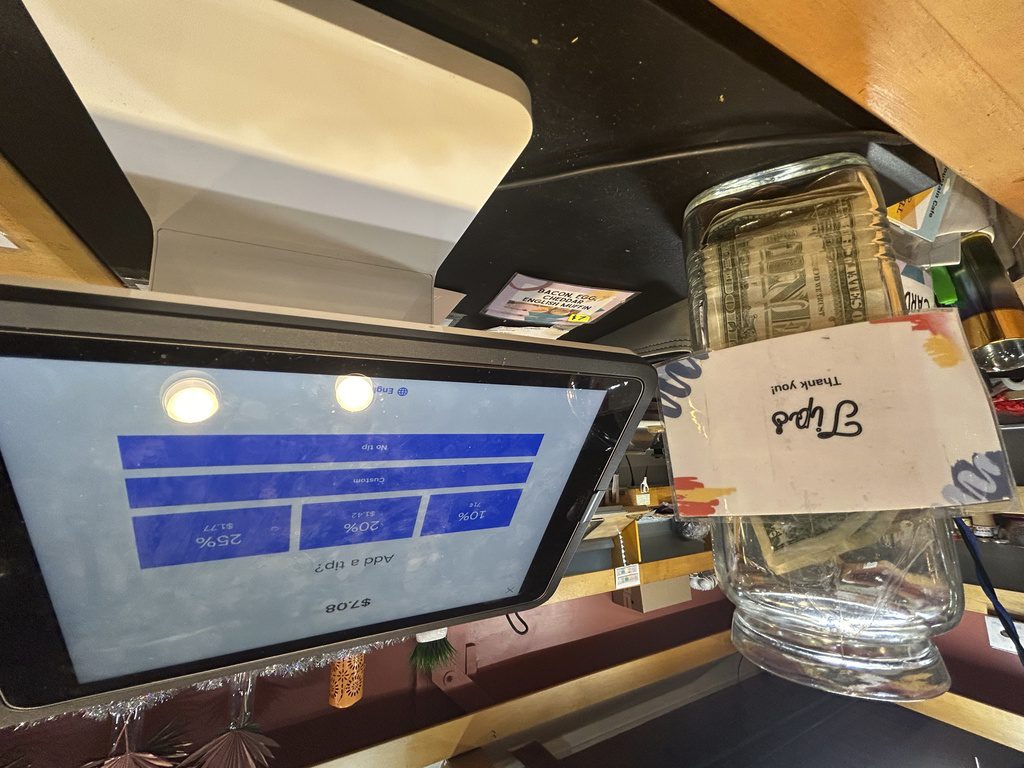

Tips to help manage your buy now, pay later loans

Between rising prices and dwindling job growth, using “buy now, pay later” on everything from concert tickets to fast food deliveries is becoming...

Nevada cities land high in WalletHub’s auto debt rankings — here’s the breakdown

Two Nevada cities rank among the top 10 nationwide for rising auto loan debt, according to a new WalletHub report that compared debt levels in the...

Opinion: Secretary Kennedy should release energy assistance funding for families

US Health and Human Services Secretary Robert F. Kennedy Jr. recently fired the entire staff that manages the Low-Income Home Energy Assistance...

‘Some people work their butts off and other people get rich’: Gwen Frisbie-Fulton’s view from rural America

Growing up, my dad only made two rules for me outside of my chores. The first one was that I wasn’t allowed to make soap with lye. Glycerine soap,...